47+ how much should mortgage be compared to income

Web How Much Mortgage Can I Afford. Web The average rate for a 15-year fixed mortgage is 630 which is an increase of 12 basis points from the same time last week.

How Much House Can You Afford Calculator Cnet Cnet

Web When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings - so the more youre committed to spend each month.

. Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment. Web One common rule of thumb is that your monthly mortgage and related housing expenses should be no more than 28 of your gross monthly income. Total monthly household income before tax 10000.

Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Generally speaking most prospective homeowners can afford to finance a property that costs between two and two-and-a-half. You already pay 1000.

Web Total monthly debt repayment 3485. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income or.

Web Generally lenders like to follow the percentages above so that your monthly mortgage payment does not exceed 28 of your gross monthly income and your total. But ultimately its down to the individual lender to decide. For example say you have a monthly gross income of 5000.

And you should make. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Debt to income ratio 3485 divided by 10000 03485 3485 or 35 just.

Web Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. Web But with most mortgages lenders will want you to have a DTI of 43 or less. However how much you.

Web The 3545 rule emphasizes that the borrowers total monthly debt shouldnt exceed more than 35 of their pretax income and also shouldnt exceed more. Compared to a 30-year fixed. Web A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability.

Lets say your total. Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance. Web NerdWallets Mortgage Income Calculator shows you how much income you need to qualify for a mortgage.

Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment. It uses five numbers home price down payment. For a 250000 home a down payment of 3.

Web If youd put 10 down on a 444444 home your mortgage would be about 400000. In that case NerdWallet recommends an annual pretax income of at least 147696.

Deezj7yjzerspm

Income To Mortgage Ratio What Should Yours Be Moneyunder30

Shawn J Bucholtz Shawnbucholtz Twitter

What Percentage Of Income Should Go To A Mortgage Bankrate

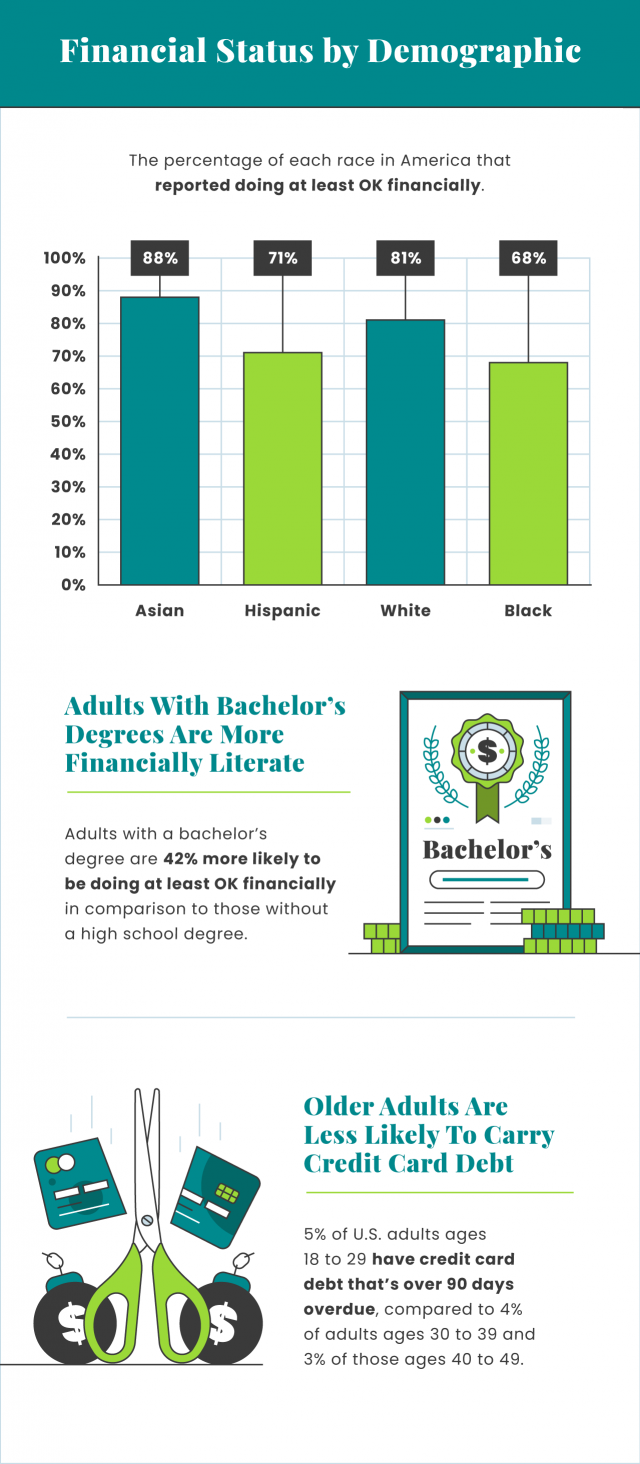

47 Fascinating Financial Literacy Statistics In 2023

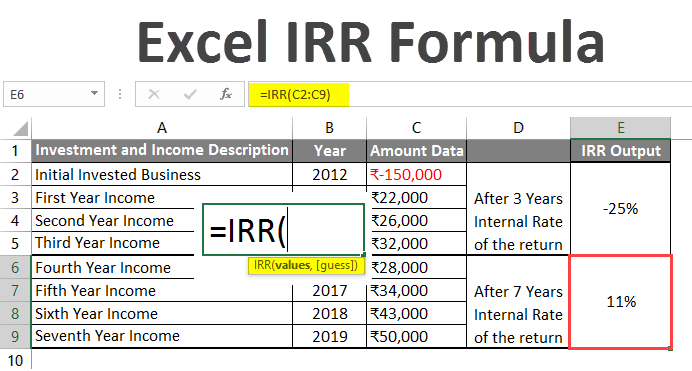

Excel Irr Formula How To Use Excel Irr Formula

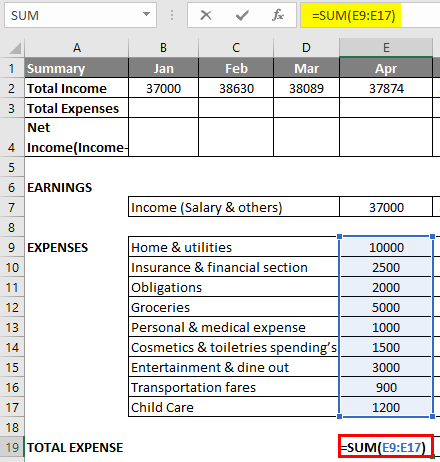

Budget In Excel How To Create A Family Budget Planner In Excel

Percentage Of Income For Mortgage Rocket Mortgage

Want To Take A Personal Loan For Wedding Here S What You Need To Know

Child Care Expenses Of America S Families

How Much House Can I Afford Insider Tips And Home Affordability Calculator

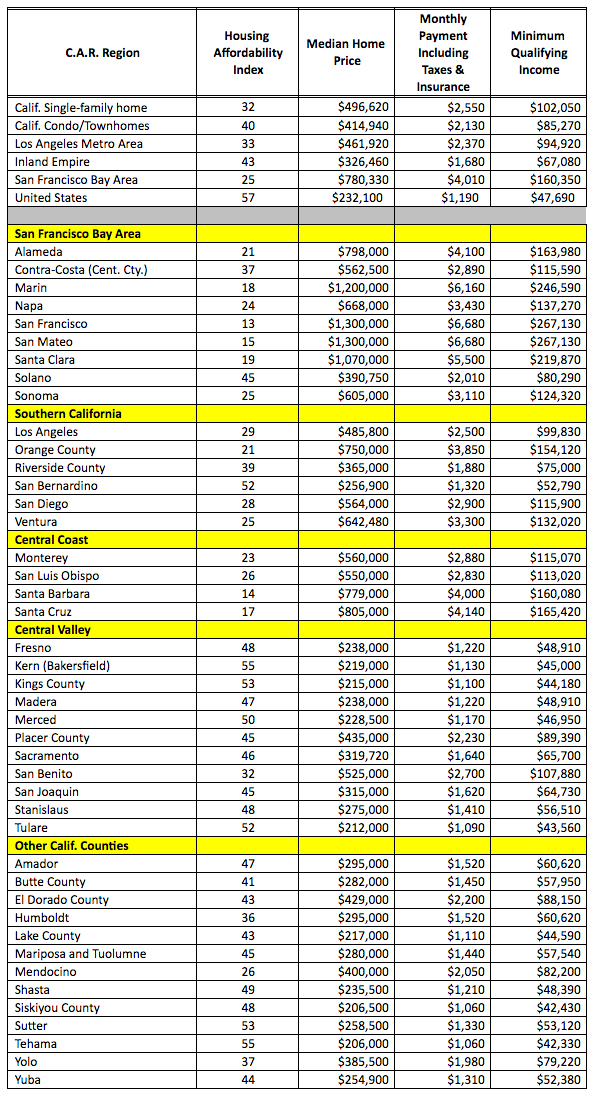

Need A Mortgage In California Realtors Say You Better Earn This Much Money Housingwire

Child Care Expenses Of America S Families

Financial Literacy Guide To Personal Finances

How Much House Can I Afford Insider Tips And Home Affordability Calculator

How Much House Can I Afford Insider Tips And Home Affordability Calculator

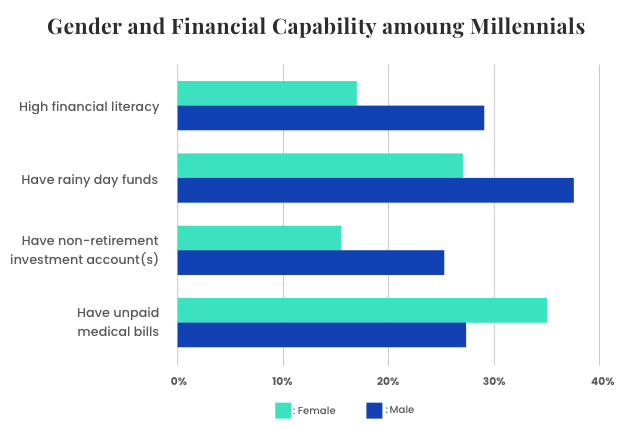

Women Financial Literacy Facts Resources Tips