Annuity factor formula

To calculate present value the k-th payment must be discounted to the present by dividing by the interest. If you retire at age 62 or later with at least 20 years of service a factor of 11 is used rather than 1.

Annuity Payment Factor Pv Formula With Calculator

FERS Basic Annuity Formula.

. Present Value Interest Factor Annuity PVIFA in Present value interest factor annuity PVIFA in represents the PV of 1 payment PMT 1 occurred at end of each period for a finite number of periods. Present Value Formula and Calculator. Generally your regular FERS retirement annuity is calculated according to this formula.

Rate Per Period As with any financial formula that involves a rate it is important to make sure that the rate is consistent with the other variables in the formula. The last difference is on future value. Installment amount assumed is Rs.

A capital recovery factor is the ratio of a constant annuity to the present value of receiving that annuity for a given length of time. The present value of an annuity is the current value of a set of cash flows in the future given a specified rate of return or discount rate. The CSRS portion of your non-disability benefit will be reduced by an actuarial factor for any CSRS refunded service performed before October 1 1990 if you do not repay the refund before retirement and.

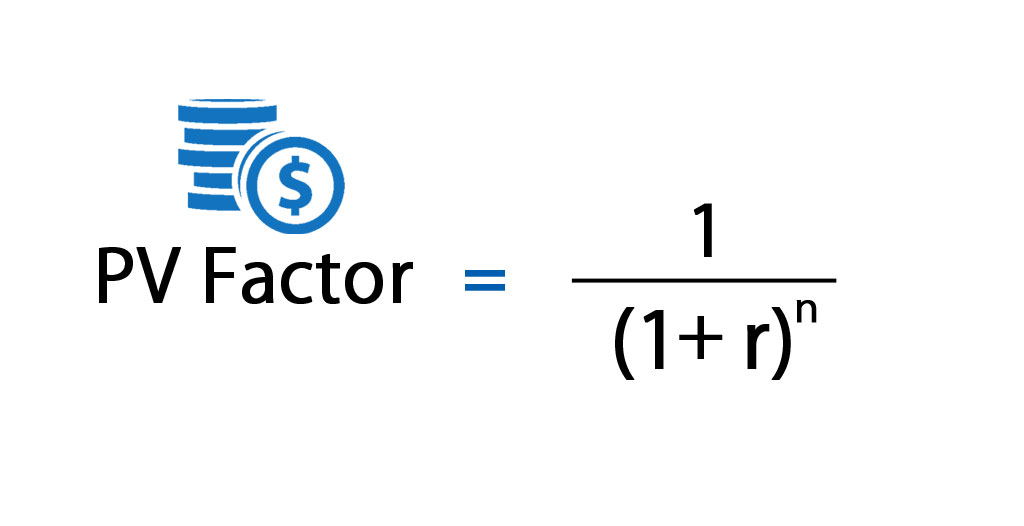

The present value formula is PVFV1i n where you divide the future value FV by a factor of 1 i for each period between present and future dates. The future cash flows of. As illustrated b we have assumed an annual interest rate of 10 and the monthly EMI Installment for 30 years.

Stands for the amount of each annuity payment r. Stands for Present Value of Annuity PMT. 1 find r as 1 115.

An annuity is a series of payments made at equal intervals. The present value of annuity formula relies on the concept of time value of money in that one dollar present day is worth more than that same dollar at a future date. Stands for the number of periods in which payments are made The above formula pertains to the formula for ordinary annuity where the payments are due and made at the end of each month or at the end of each period.

An annuity is a contractual financial product sold by financial institutions that is designed to accept and grow funds from an individual and then upon annuitization pay out a stream. Find PVOA factor as. 1 of your high-3 average pay times years of creditable service.

Proof of annuity-immediate formula. The Society of Actuaries SOA developed the Annuity Factor Calculator to calculate an annuity factor using user-selected annuity forms mortality tables and projection scales commonly used for defined benefit pension plans in the United States or Canada. Using an interest rate i the capital recovery factor is.

An annuity dues future value is also higher than that of an ordinary annuity by a factor of one plus the periodic interest rate. Stands for the Interest Rate n. This tool is designed to calculate relatively simple annuity factors for users who are accustomed to making actuarial.

The present value formula applies a discount to your future value amount deducting interest earned to find the present value in todays money. Each cash flow is compounded for one additional period compared to an ordinary annuity. FV of an Annuity Due FV of Ordinary Annuity.

The formula can be expressed as follows. Where is the number of annuities received. By looking at a present value annuity factor table the annuity factor for 5 years and 5 rate is 43295.

This is the present value per dollar received per year for 5 years at 5. Under Age 62 at Separation for Retirement OR Age 62 or Older With Less Than 20 Years of Service. Other TVM formulas can be achieved by simplifying or extending equation 1 or 2 the formula for the PV or FV of growing annuity.

This is related to the annuity formula which gives the present value in terms of the annuity the interest rate and the number of annuities. For example an individual is wanting to calculate the present value of a series of 500 annual payments for 5 years based on a 5 rate. Present Value Factor Formula in Excel With Excel Template In this example we have tried to calculate a present value of the Home Loan EMI using the PV factor formula.

Present Value Of An Annuity.

Present Value Annuity Factor Formula With Calculator

Present Value Factor Formula Calculator Excel Template

Present Value Of Annuity Formula Calculate Pv Of An Annuity

Future Value Of Annuity Formula With Calculator

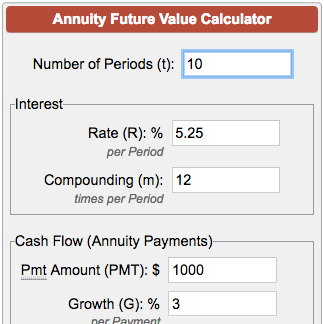

Future Value Of Annuity Calculator

Present Value Of An Annuity How To Calculate Examples

How To Calculate The Present Value Of An Annuity Youtube

Excel Formula Future Value Of Annuity Exceljet

Annuity Formula What Is Annuity Formula Examples

Future Value Of An Annuity Formula Example And Excel Template

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Present Value Of Annuity Due Formula Calculator With Excel Template

Annuity Due Formula Example With Excel Template

Excel Formula Present Value Of Annuity Exceljet

Annuity Present Value Pv Formula And Calculator Excel Template

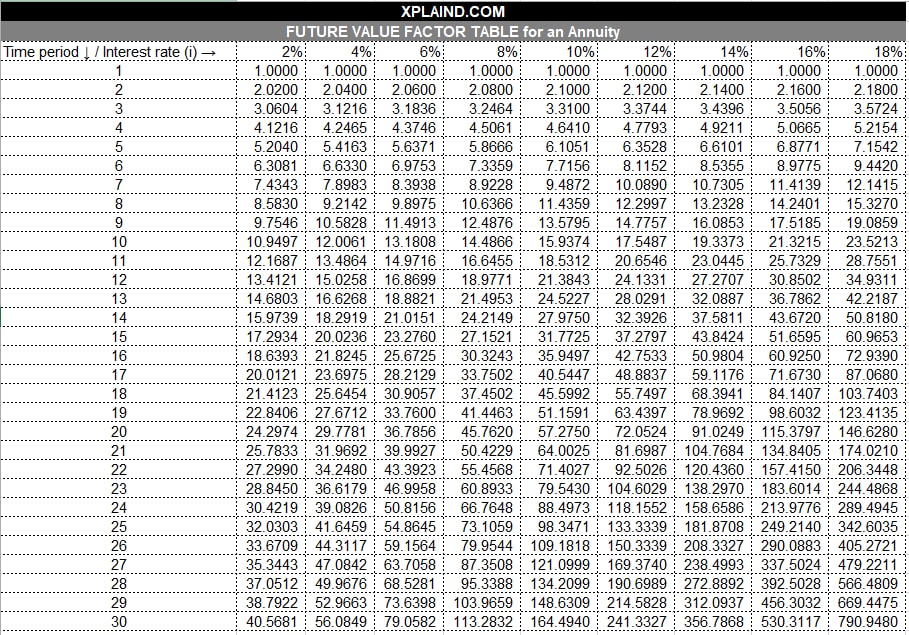

What Is An Annuity Table And How Do You Use One

Future Value Factor Of A Single Sum Or Annuity